Corporate Tax Lawyer

Being an entrepreneur is undoubtedly a busy time. You're so busy with your business activities that it's hard to keep up with tax issues.

Corporate tax is almost metaphorically complex but very hot to deal with daily. You need the support of professionals who can handle this complexity daily.

We are a group of professional accountants who are well versed in tax legislation and can guide you through your annual tax returns as well as your periodic tax returns.

Our Corporate Tax Services

We offer the following services

- Preparation and filing of tax returns for businesses and executives

- Assistance in understanding and translating tax legislation

- determination of taxable income and tax payments

- obtaining tax exemptions and tax certificates

- assisting in responding to reminders from tax authorities

- Representing clients before tax authorities, audit committees, and the FBR on various issues.

Is your company's tax compliance in line with today's complex tax environment?

To manage corporate taxes in a disciplined and coordinated manner, you need experienced tax professionals who understand the specific tax issues facing your business. We understand tax laws, procedures, and techniques and how they interact with your business strategy and mission to achieve successful tax results.

Our comprehensive corporate tax services are particularly useful, for example, for companies and tax authorities that have been or are facing unconventional changes.

- Changes in management

- Technical adjustments

- Major regulatory changes

- Changes in the business

- Expansion into new markets or services

Implementation can be complex, but we can simplify it for you.

Our tax professionals work with our federal, international, state, and local experts, as well as our tax technology specialists, to find and develop compelling solutions to your tax issues. These include

- Compliance with the tax laws of all jurisdictions, including international, state, and local.

- Taxation of profits

- Implementing and improving technology

- Improving procedures and workflows

- Tax services related to mergers and acquisitions

- Collaboration and outsourcing of work and processes

- Special tax consulting

- Strategic tax planning

Helping Businesses Reduce Taxable Income:

In the undeniably complex areas of financial reporting, tax compliance, and tax organization, corporate tax departments are often forced to keep up with changing demands.

By adding our experience and industry expertise, we can enhance the resources available to your tax department and give you the peace of mind you need to realistically address the issues affecting your business today and in the future. Analyzing financial information in tax jurisdictions requires a higher level of diligence, accuracy, and internal control.

As trusted advisors and partners, AskWakeel's tax professionals work with clients to gain a deeper understanding of their businesses, including global markets and organizations operating in national and local jurisdictions. We facilitate and enhance your understanding of tax reporting and design, as well as tax administration rulings and procedures that impact your income tax accounting.

We identify areas of risk and propose programs to improve financial statement reporting and tax compliance.

Our expertise, efficiency, diligence, and unparalleled service are highly valued by our clients and colleagues.

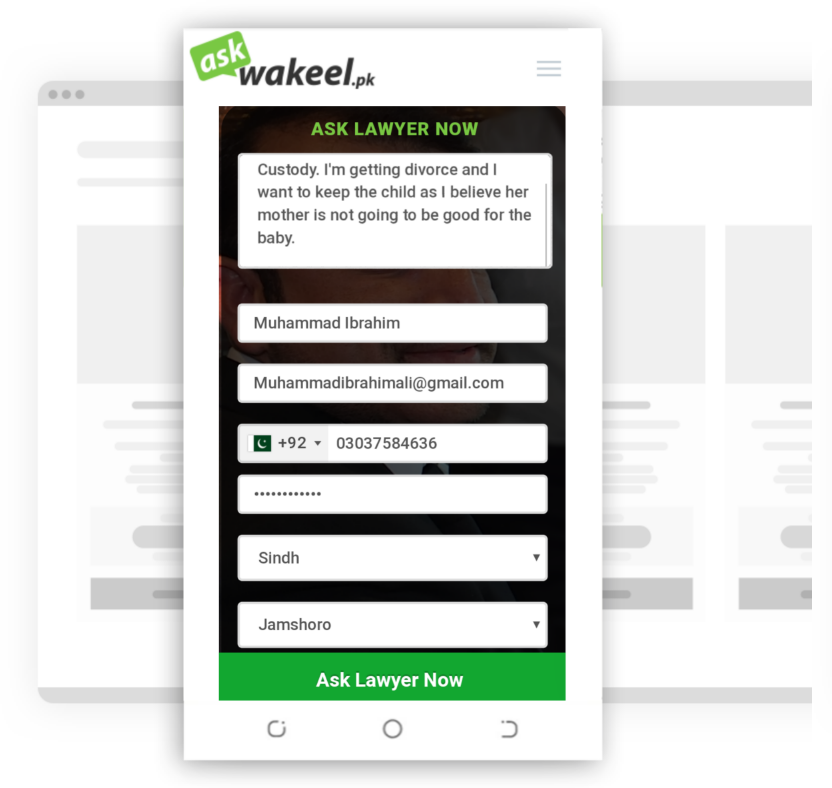

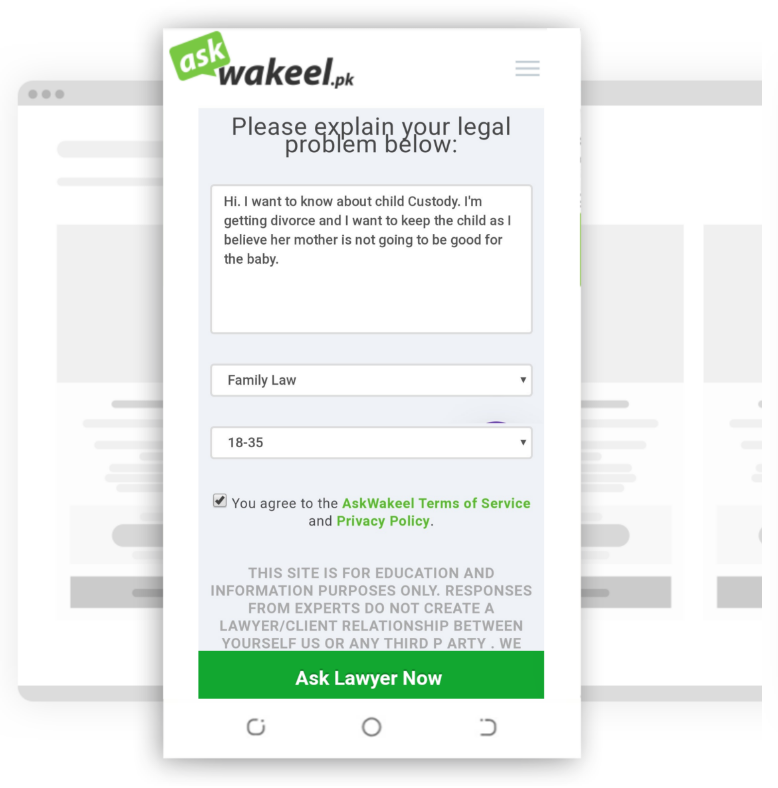

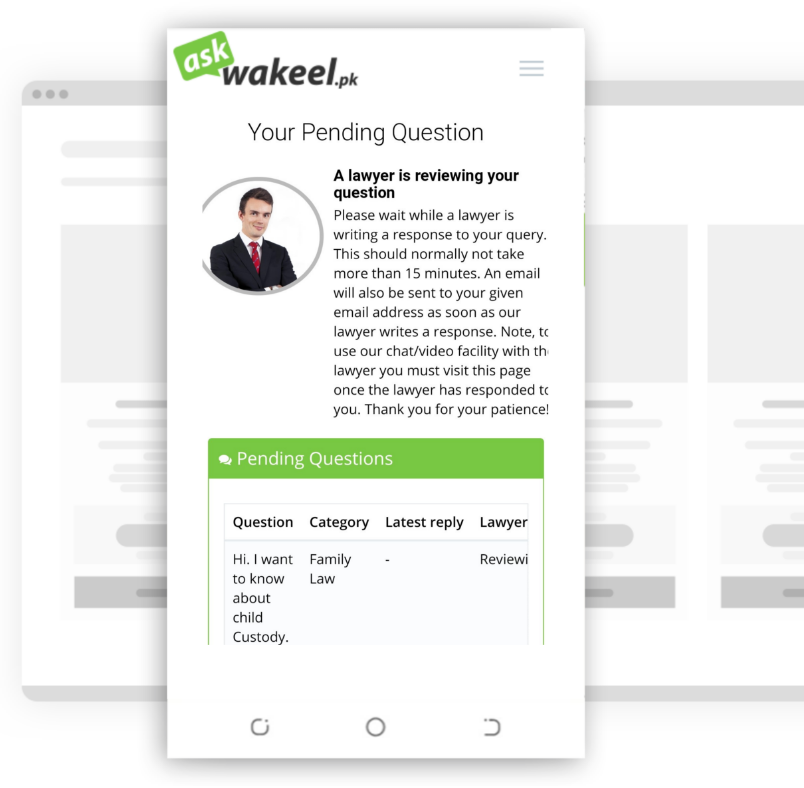

How does it work ?

Are you looking to post your Legal Question? Now it's very simple, just post your question and get immediate advice from experienced and best Askwakeel Lawyers in your area